As Congress debates how to extend the expiring 2017 Trump tax cuts, a new poll from the Cato Institute suggests the American people support an approach that pairs tax relief with significant spending cuts.

The House and Senate have passed a budget framework to make the 2017 tax cuts permanent, increase spending on immigration and defense, and, if the House has its way, cut as much as $2 trillion in other spending. While the Senate version of the resolution includes no meaningful enforceable spending cuts, fiscal hawks have reported receiving a commitment to pair tax cuts with at least $1.5 trillion in spending cuts.

The results from the Cato Institute’s 2025 Fiscal Policy National Survey by Emily Ekins, fielded in collaboration with YouGov, show that respondents across the political spectrum support keeping taxes low by pairing spending cuts with making the 2017 Tax Cuts and Jobs Act permanent.

Emily Ekins and Hunter Johnson’s in-depth summaries of the results are available here and here.

I’ve pulled out some of the most striking results from the survey.

Taxes are already too high

Most Americans (55 percent) think their taxes are too high, a view also shared by more than half of Democrats. The same portion of respondents believe they pay more than their fair share in taxes when considering “what you get from the federal government.”

A full 81 percent of Americans say they can’t afford higher taxes next year.

Permanent tax cuts are important

Americans, regardless of political affiliation, want permanent tax cuts. Seventy-five percent agree with the statement, “the 2017 tax cuts should be made permanent because businesses and families need stability of the tax code to plan for the future.” And 74 percent agree that “tax cuts should be made permanent because taxes are already too high.” More than half of “very liberal” respondents also agreed with both statements.

Eighty-five percent of Americans want to extend the 2017 tax cuts when told the average person’s taxes will increase between $1,000 and $2,000.

Pair tax cuts with spending cuts

Some in Congress argue that “the 2017 tax cuts should expire because it won’t be worth the federal spending cuts necessary to make them permanent”—61 percent of Americans disagree with that statement.

With an annual budget deficit of $2 trillion, 64 percent of respondents want to primarily cut spending to balance the budget. A plurality (49 percent) only want to cut spending to balance the budget.

When given more options to finance federal deficits, the most popular options are auditing federal spending and cutting federal spending. The two least popular options are borrowing money and raising taxes across the board.

More than three in four Americans think the federal government spends too much, and they report that 59 cents of every dollar is wasted, a share that has risen considerably over time. Even Democrats offer that they would cut 32 percent of spending to balance the budget.

Americans understand that spending cuts are also pro-growth, with 78 percent reporting that cutting spending will mostly help or have no impact on the economy—a sentiment supported by 63 percent of Democrats. Only 15 percent of all respondents think the massive increase in federal spending over the last decade has improved their quality of life.

Support for investment expensing, lower corporate tax rate

While most of the public conversation around the extension of the 2017 tax cuts focuses on individual tax provisions, the most pro-growth things Congress is considering are business tax cuts.

When asked about extending or eliminating full expensing—which allows businesses to deduct the cost of new machinery and other investments upfront—63 percent of Americans support the policy. When presented with arguments for and against full expensing, support for the policy remains strong, with 57 percent support among all respondents.

Americans also register strong, bipartisan support (60 percent among all respondents) for extending the full deduction for research and development expenses.

In 2017, Congress permanently cut the federal corporate tax rate from 35 percent to 21 percent. Some have proposed raising the rate this year. However, 66 percent of Americans think the corporate rate should be lowered further or stay the same—the plurality (46 percent) want it to remain the same.

When asked, 60 percent of respondents agreed with the statement, “We should lower the corporate tax rate because it brings business and jobs back to the United States.” Respondents’ answers are susceptible to how questions are framed, although Republicans maintain strong support for a lower corporate tax rate.

Among Republicans, 56 percent strongly or somewhat favor cutting the federal corporate tax rate from 21 percent to 15 percent.

Repeal green energy tax credits, other credits and deductions

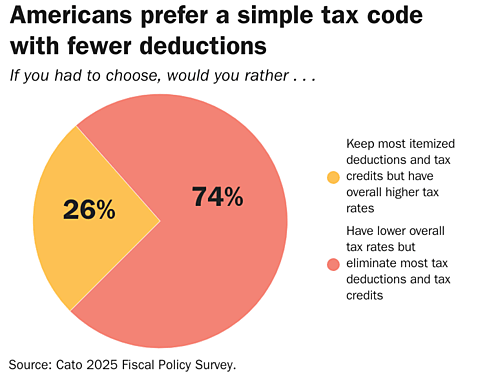

Beyond spending cuts, Congress can also pair tax cuts with new limits on special-interest tax credits and deductions. Cutting credits and deductions is very popular, with 74 percent of respondents choosing to “have lower overall tax rates but eliminate most tax deductions and tax credits.” This broad-based, low-rates formulation of tax reform maintains support above 60 percent in every demographic group in the survey.

When asked about repealing the roughly $1 trillion in energy and environment policy subsidies to help keep the 2017 tax cuts, 59 percent of Americans strongly or somewhat favor repealing the Inflation Reduction Act tax credits.

The 2017 tax law set a $10,000 limit on state and local tax (SALT) deductions to help offset lower tax rates. With strong support across ideological differences, 64 percent of all respondents say they want to extend the SALT cap. However, overall support for the policy flips when the limit is framed as a double tax—although Republicans remain supportive of maintaining the $10,000 cap on SALT deductions even with different framing.

Broad support for wealth creation

The majority (54 percent) of Americans admire the rich, and 65 percent disagree with the statement, “Wealth should be taken from the rich and given to the poor.”

Three out of five Americans strongly agree, and 90 percent strongly or somewhat agree that “there is nothing wrong with trying to make as much money as you can.” Furthermore, when asked about billionaires, 71 percent disagree that it is immoral for society to allow people to become billionaires, 62 percent think they make us better off, and a majority (52 percent) don’t think rich people threaten democracy.

A clear path forward

Congress is pursuing tax and budget reform through reconciliation this summer. Polling from the Cato Institute shows a clear mandate from Americans: extend the 2017 tax cuts permanently and sharply reduce federal spending.